TOKENLEND

Traditional banking products and services are very old and sluggish because of all the bureaucracy and terms of the required documents. In the world of transcontinental currency transfers, decentralized databases and smartcontract , people are still limited by their geographic location and residence. Different legislation, currency and complicated taxes make business activities more complicated than they should and may be. The lack of integration between financial services forces people to deal with many intermediary institutions with their own verification policies, costs and restrictions. This can change seemingly simple operations to be complicated.

WE OFFER

- Loan Portfolio

TokenLend platform will be released with pre-arranged list of secured loans from trusted EU loan originators, and user-friendly interface for our future partners. At the first stage we will accept only mortrage loans with the most trustworthy real estate properties as a pledge. It will allow to achieve best risk/income value for our users.

- Secondary Market

TokenLend will have a Loan Participation Note (LPN) market (i.e. “Secondary Market”) where users can trade ongoing investments for immediate liquidity.

- Decentralized Architecture

Platform's business logic will utilize all benefits of blockchain technology by using Ethereum distributed ledger. Representing every object as a smart-contract and performing all operations as token transactions between Ethereum addresses will help to achieve outstanding stability, integrity and invulnerability of system data.

- The loan originator adds a new loan to the system via the Dashboard. After the loan details are validated and successfully verified by platform personnel, the loan smart contract is created and published onto the platform.

- Users purchase Loan Participation Notes (LPN) for a particular loan by transferring a desired amount of TLN to the loan address. The loan smart contract then generates the LPN contract with a principal value equating to the amount of TLN transferred by the user as well as a personal repayment schedule according to the creation timestamp of the LPNs and loan terms.

- The LPNs are linked to the user’s ETH wallet address as the beneficiary of the interest payments. The total amount of TLN received from all users are transfers to the Loan Originator’s account as the loan principal.

- In accordance with the loan smart contract schedule, the loan originator sends interest payments and principal repayments (if applicable) total to the platform.

- After performing the last transaction by the loan originator, the LPN contract closes the repayment schedule and sends the interest along with the remaining TLN principal to the associated account.

- The loan is then considered closed, the wallet address association is removed and the LPN contract is considered fully executed.

On average, loan originators in EU offer real estate secured loans to borrowers with a 10-14% interest rate. At the same time they are open to accept funds from any available sources with a 5-8% interest rate. This is where TokenLend can come in and securely connect both parties.

As a result, platform users have an accessible source of investment opportunities and loan originators have access to affordable funds.

The TokenLend business model will provide flexible pricing for both loan originators and common investors. The exact fees will be determined for each individual loan originator based on their health and value of loan portfolio existing on the platform.

A “sale fee” will be charged to investors for the successful sale of LPNs to other investors on the TokenLend platform. This fee will apply to both common P2P platform investors and token holders.

A withdrawal fee will also be applied for every transaction in fiat currency.

SOLUTIONS

The idea for TokenLend comes from the peak of our investment experience and our extensive experience in software development. Our goal is to build a reliable and reliable ecosystem that provides a complete funding loan for all parties involved. TokenLend will give people around the world the ability to invest in real estate loans using a variety of crypto and fiat currencies. Our platform will remove the uncertainty facing small investors by helping them build secure loan-based investment portfolios that provide competitive, predictable and consistent rates of return. The platform will contain a carefully selected list of carefully selected loans and pre-checks available for investment. TokenLend will only receive loans from trusted EU loan originators. The presence of a legal entity as a counter party allows us to take the necessary precautions in advance to receive timely payments by the lender and reduce the risk of default. TokenLend personnel will re-validate information received by the lender, including personal data of the borrower, appointment information, appraisal and LTV ratios. Loans will only be listed on the platform if they meet the loan selection criteria for those that meet TokenLend criteria. TokenLend personnel will re-validate information received by the lender, including personal data of the borrower, appointment information, appraisal and LTV ratios. Loans will only be listed on the platform if they meet the loan selection criteria for those that meet TokenLend criteria. TokenLend personnel will re-validate information received by the lender, including personal data of the borrower, appointment information, appraisal and LTV ratios. Loans will only be listed on the platform if they meet the loan selection criteria for those that meet TokenLend criteria.

TOKEN SALE DETAILS

Total supply: 130 411 585 TLN

ICO supply: 93 750 000 TLN

Token price: 1 ETH = 2 500 TLN

Soft cap is: 5 000 ETH

Hard cap is: 41 000 ETH

TLN TOKEN

In the Initial Coin Offering (ICO) campaign, TokenLend will offer a Lend Coin token (TLN) for sale. The TLN Token is a digital representation of the rights to exclusive membership on the TokenLend platform. TLN holders have the ability to invest the desired amount of funds from their accounts into every available loan listed on the TokenLend P2P platform. The account balance on the platform represents the number of TLN tokens stored in the Etherealum of a member TokenLend account at any given time. The TLN token will be traded outside the TokenLend platform. Since they are the ERC-20 tokens, they will have an inherent value on the exchange. Tokens purchased during ICO campaigns will provide two types of revenue for holders. Token holders can use TLN to invest in registered loans on the platform and receive revenue like other platform users. However, only ICO participants will receive a regular revenue share from platform operations. The TLN token holder is guaranteed a share of the company's profits. The distribution size will be determined by the proportion of tokens associated with each member's account on the date of payment.

The LPN market will allow users to trade LPN with each other, this is only available to registered users. Users are not required to sell at the original cost of LPN, they can send orders for a specific LPN at the desired price at TLN.

Users can also add comments and details about LPN to be sold. All transactions will be done by sending TLN from one address to another. LPNs will be considered to be sold once the TLN transaction is confirmed by the Ethereum network and at which time the LPN owner changes automatically.

ICO & TOKEN DISTRIBUTION

- Pre-sale - 7% of all tokens will be sold during pre-sale. All pre-sale participants not only have the opportunity to purchase a TLN token with a special discount, but also have exclusive rights to participate in the beta platform testing stage and receive investment benefits before other token holders.

- ICO - 75% token will be distributed during ICO. All unsold tokens will be destroyed.

- Advisor - 3% token will be given to our legal and advisory teams for his contribution. This token will be locked * for a 12 month period.

- Team - 14% token will be allocated to TokenLend founder and team core. 50% of these tokens will be locked * for a period of 24 months, and the remaining 50% will be locked * for 48 months.

- Bounty - 1% token will be allocated for various campaign activities.

Total amount of funds to be allocated is - 800 ETH.

The budgeted funds will be withdrawn in full prior to starting the development. They will be distributed amongst various departments and activities in the following manner:

- 70% CORE DEVELOPMENT : The entire development process of the Tokenlend platform and its proprietary features.

- 18.6% MARKETING AND PR : The strategic process of attracting investors and loan originators to the platform in order to generate revenue.

- 7.0% LEGAL : Most of the legal funds will go towards developing a strong legal framework for the Tokenlend business structure, the remainder will to towards accounting and administration activities.

- 2.6% CONSULTING : For the future consulting services of SMEs. In particular, business domains to gather requirements for the development of new platform features.

- 1.8% OFFICE EXPENSES : Rental, utility and other costs.

- Participants willing to contribute to the development of Tokenlend platform can do so by sending

- Ether to the token sale smart-contract.

- Contributors purchase TLN tokens at the base rate of 0.0004 ETH for 1 TLN

- The pre-sale will start on the 1st of March 2018 and run for 11 days and will be capped at 3 500 ETH with a minimum contribution of 1 ETH

- The sale will begin on the 26th of March 2018

- The contribution period will run for 45 days

- During the ICO, there will be soft cap of 5 000 ETH and a hard cap of 41 000 ETH

- All unsold tokens will be burned

- TLN tokens received by contributors will be transferable 7 days after the end of Initial Coin Offering campaign

Tier 1: 0 >= 1000 ETH - 10% bonus tokens

Tier 2: 1000 >= 3000 ETH - 7% bonus tokens

Tier 3: 3000 >= 9000 ETH - 5% bonus tokens

Tier 4: 9000 >= 21000 ETH - 3% bonus tokens

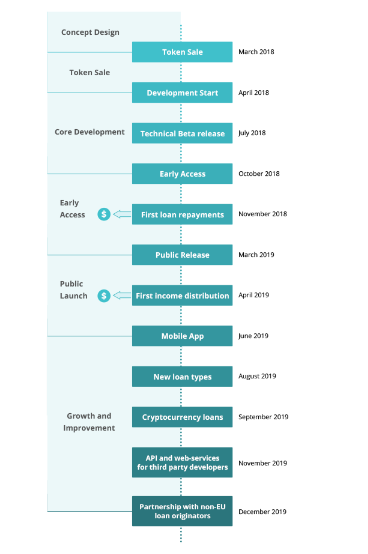

ROADMAP

Sergei Naiden - CEO

Robert Morris University, USA:

Master of Science, Banking, Corporate, Finance and Securities Law.

Series entrepreneurs with 25+ years experience in managing large companies and 10+ years of experience in the ownership and management of international IT companies. The world's leading developer and vendor of software products; Daemon Tools

Ivan Kovtun - COO

Vitaliy Russkih - CTO

Alexandr Petrov - Blockchain Architect / Lead Developer

Senior developer with more than 12 years' experience in designing and implementing enterprise-class solutions including development of kernel drivers and embedded system development. 3+ years experience in designing blockchain solutions for IoT and FinTech.

Maria Viter - CMO

Industry professional with more than 8 years experience in marketing software products and 5+ years experience in business development from DAEMON Tools product line.

Ask Chuh - CCO

Senior specialist with more than 5 years experience in public relations activities, specializing in building public relations and community management strategies for companies operating in the stock market and international software vendors.

FOR MORE INFORMATION LINK :

Website : https://tokenlend.io/

Whitepaper : https://tokenlend.io/tokenlend_whitepaper.pdf

Facebook : https://www.facebook.com/tokenlend/

Twitter : https: // twitter.com/Tokenlend_news

Telegram : https://t.me/tokenlend_bounty

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1811483

Komentar

Posting Komentar